► Equity market valuations are broadly reasonable adjusted for the cyclical low in earnings and

potential for revival going forward.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

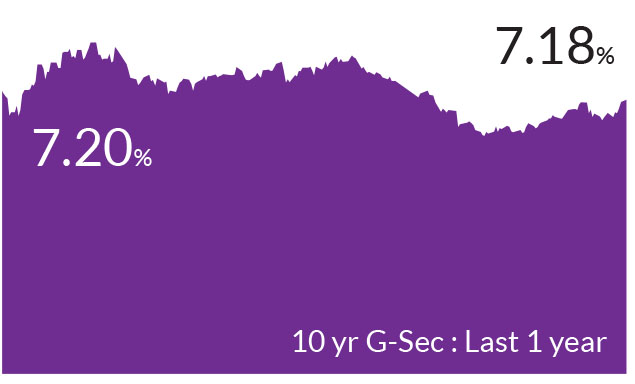

► Broadly interest rate cycle and inflation cycle have peaked both in India and globally

► Investors should add duration with every rise in yields

► Mix of 10-year duration and 2-4-year duration assets are best strategies to invest in the current macro environment.

► Credits continue to remain attractive from a risk reward perspective give the improving macro fundamentals.

► Investors should add duration with every rise in yields

► Mix of 10-year duration and 2-4-year duration assets are best strategies to invest in the current macro environment.

► Credits continue to remain attractive from a risk reward perspective give the improving macro fundamentals.

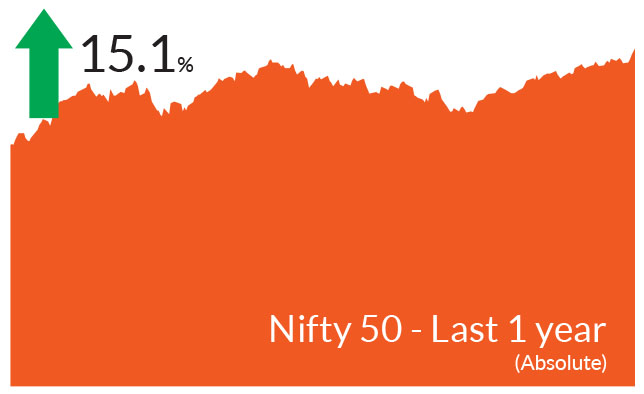

The positive momentum seen in the last three months continued in July.

With the bulls taking charge of the stock markets since April,

benchmark indices soared further and finally broke through the

previous all-time highs in July. All indices scaled new lifetime highs,

prominently the BSE Sensex crossed the 67,000 mark while the Nifty

50 inched close to the 20,000 mark. S&P BSE Sensex & NIFTY 50 ended

the month up 2.8% and 2.9% respectively. NIFTY Midcap 100 & NIFTY

Small cap 100 continued to outperform their large cap peers, up 5.5% &

8% respectively. Market breadth continued to remain strong while

volatility declined further over the month.

► Higher Inflationary pressures : Headline inflation climbed to 4.8% in June, from 4.3% in May due to a sharp rise in vegetable prices. Soaring tomato, vegetable and cereal prices could push inflation above 6% over the next two months. However, these should cool off over a period of few months. Core CPI momentum is softening, with hardly any increase and overall rainfall has been catching up which gives comfort that inflation would not be a worry for next 12 months. While inflationary risks have increased marginally in near term, we believe that the Reserve Bank of India's (RBI) monetary policy meeting on 8-10 August may result in a status quo and rates will not be increased.

► Continued improvement in Monsoon : Total rainfall stood at 7% above long period average driven by pick up in central India and south India. On a cumulative basis, rainfall was deficient in east and north-east India, normal in central India, south India, and excess in north India. A delayed rainfall exacerbated fears of an El Nino and concerns that a deficit in rainfall could lead to higher food prices. The growth of the agriculture and allied services sector is influenced by the monsoon as 51% of the cropped area is monsoon dependent.

Key Market Events

► External events lead to rise in bond yields: US Treasury yields rose towards the end of the month, with the 10-year rising above 4%, after data releases suggested that the US economy remained strong. The numbers defy fears of a recession despite the Fed's aggressive tightening. The Fed raised interest rates by a widely expected 25 bps and we believe incremental hikes would be data dependent. Separately, the BoJ tweaked the yield control curve by adding flexibility to raise long term rates if inflation continues higher. Effectively the upper band of the curve has changed from 0.5% to 1% which could lead to a strengthening of the yen and an uptick in global bond yields. Indian government bond yields should not be impacted by this change.► Higher Inflationary pressures : Headline inflation climbed to 4.8% in June, from 4.3% in May due to a sharp rise in vegetable prices. Soaring tomato, vegetable and cereal prices could push inflation above 6% over the next two months. However, these should cool off over a period of few months. Core CPI momentum is softening, with hardly any increase and overall rainfall has been catching up which gives comfort that inflation would not be a worry for next 12 months. While inflationary risks have increased marginally in near term, we believe that the Reserve Bank of India's (RBI) monetary policy meeting on 8-10 August may result in a status quo and rates will not be increased.

► Continued improvement in Monsoon : Total rainfall stood at 7% above long period average driven by pick up in central India and south India. On a cumulative basis, rainfall was deficient in east and north-east India, normal in central India, south India, and excess in north India. A delayed rainfall exacerbated fears of an El Nino and concerns that a deficit in rainfall could lead to higher food prices. The growth of the agriculture and allied services sector is influenced by the monsoon as 51% of the cropped area is monsoon dependent.

Market View

Equity MarketsStrong consistent FPI inflows have been driving the market momentum with India receiving more than 85% of all fund flows into key emerging Asian markets (excluding mainland China) since April. So far, roughly 33 Nifty 50 companies have reported results, and the earnings season has been in line with estimates. Results of IT companies have been weaker while banks saw a steady improvement in margins and asset quality; and automobiles reported mixed results. Markets from here could see earnings led incremental gains. Some companies are likely to benefit over others on account of flexibility, product differentiation and market leadership. This pocket-wise growth rather than 'across the board' and active investing in growth and quality are likely to be key to alpha creation.

Our fund performance has seen a strong rebound driven by active stock selection driving much of this recovery. This unique trait across portfolios has historically been key to long term wealth creation and this is reflected in our conviction plays across schemes. Accordingly, consumption and investment led sectors are the key themes. Within financials, we prefer select names that have seen an improvement in their balance sheets. Our allocations in select IT companies are purely stock specific strategies and in stories where we believe are likely disproportionate beneficiaries over the medium term. Markets at alltime highs also point to a valuation risk in select pockets which we will look to avoid. Meanwhile, the BSE Value Index has done relatively well compared to other style indices.

Debt Markets

Though headline inflation could be above RBI's comfort zone and real rates post increased food inflation could be ~100 bps, we do not believe that the RBI would really be as concerned. CPI for the year should stay contained around 5.25% and the large increases on account of higher tomato prices should cool off. Another factor favouring inflation over the next 12 months is the catchup in overall rainfall. Accordingly, RBI's tone could be cautious in the upcoming monetary policy and structurally do not believe a hike is on the cards. Furthermore, RBI could lower rates only if growth falls below 5.5% and the Fed lowers its interest rates. If this scenario plays out, we believe RBI would move towards a neutral stance and markets despite no cuts would start pricing in 50 bps cuts.

Most part of funded (government /corporate bonds) and non-funded (swaps) fixed income curve is pricing in no cuts for the next one year. We believe that we are at peak of interest rate cycles, globally as well as in India and probability of further hikes are limited. We do expect the 10- year bond yields to touch 6.75% by April - June 2024. Investors should use the uptick in yields to increase duration and should stick to short to medium term funds with tactical allocation to long / dynamic bond funds in this macro environment. One can expect yields to be lower by 25-40 bps in next 6-12 months across the curve.

From a portfolio standpoint, in line with our medium-term view, our portfolios currently run duration at the higher end of the respective investment mandates. Our expectations of incrementally softening yields across the curve and a possible policy pivot in favor of softening rates in the latter half of the financial year, this has already been factored into the current portfolio positioning. For investors with a medium-term investment horizon, we continue to believe actively managed duration strategies offer ideal investment solutions to capitalize on a falling interest rate outlook and attractive 'carry' opportunities as compared to comparable traditional investment solutions.

Source: Bloomberg, Axis MF Research.