► Equity market valuations are broadly reasonable adjusted for the cyclical low in earnings and

potential for revival going forward.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► Interest rate cycles have peaked both globally and in India.

► Investors should add duration with every rise in yields.

► Mix of 10-year duration and 2-4-year duration assets are best strategies to invest in the current macro environment.

► Credits continue to remain attractive from a risk reward perspective give the improving macro fundamentals.

► Investors should add duration with every rise in yields.

► Mix of 10-year duration and 2-4-year duration assets are best strategies to invest in the current macro environment.

► Credits continue to remain attractive from a risk reward perspective give the improving macro fundamentals.

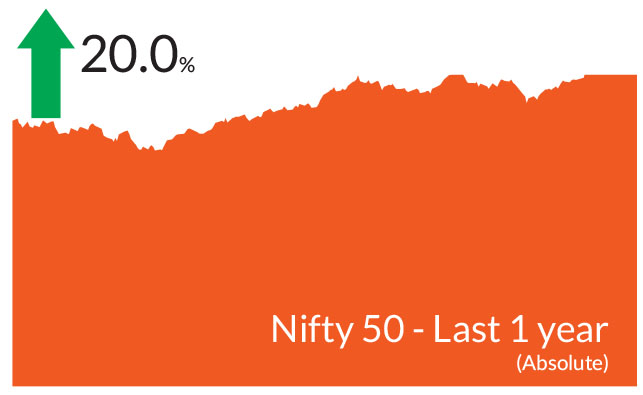

Indian markets ended the year on a strong note with S&P BSE Sensex &

NIFTY 50 ending the month higher 7.8% & 7.9% respectively. Although

subdued by large caps this month, NIFTY Midcap 100 & NIFTY Small

cap 100 ended the month up 7.6% & 6.9% respectively. Key benchmark

indices such as the BSE Sensex crossed the 72,000 mark while the

NIFTY 50 inched towards the 22,000 mark. All sectors delivered

positive absolute and relative returns in December. Market breadth

was strong as seen in the advance/decline ratio while volatility was

higher compared to the previous month. Indian government bond

yields fell over the month, trading in a narrow band of 7.16-7.29% and

ending at 7.19%.

► Inflationary pressures and oil prices head lower: Headline inflation rose to 5.6% in November 2023, led by increase in food price, after falling below 5% in the previous month. Nevertheless, core inflation stood at 4.1% and continues to maintain downward momentum. As widely expected, the Reserve Bank of India (RBI) to maintained a pause in its December monetary policy meeting. Crude oil prices inched to $73 levels but ended down 7% at $77. Crude rose from its December low as Houthi attacks on vessels in the Red Sea forced tankers and other ships to divert on longer voyages, boosting costs. Nonetheless, in 2023, crude declined 10% due to geopolitical conflict in the Middle East and concerns about the oil output levels of major producers around the world.

► Macro indicators remain favourable: Domestic demand remained robust even as there were signs of moderation in November driven by the festival-related holiday impact. Industrial production in October registered a robust growth at 11.7% compared with an upwardly revised 6.2% reading in September, aided by a favorable base effect and pre-festive sequential pick-up. Manufacturing sector grew 10.4% while consumer durables and consumer non-durables grew 15.9% and 8.6% respectively. PMI manufacturing rose to 56 in November from 55.5 in October, remaining in expansionary zone since July 2021. Meanwhile, credit growth rose to 16.3% in November from 15.3% in October.

Key Market Events

► US Treasury yields retreat over the month: USUS Treasury yields ended further lower in December amid increasing optimism that the Federal Reserve (Fed) will keep interest rates on hold and may lower them in the second half of the next year. The yields on the 10-year Treasury fell to 3.9%, a significant decline of 50 bps from previous month's close of 4.3%. Meanwhile, the yields on the 2 year Treasuries fell marginally lesser than the longer end leading to the yield curve getting less inverted to flat. In its December policy meeting, the Fed maintained rates on hold. Alongside its interest rate decision, the Fed also upgraded its growth outlook for this year and reduced it for 2024. It cut its inflation outlook for both years as well. Members of the Federal Open Market Committee also cut the median projection for interest rates at end-2024 to the midpoint between 4.50 and 4.75. This signals they now expect 0.75 percentage points of cuts.► Inflationary pressures and oil prices head lower: Headline inflation rose to 5.6% in November 2023, led by increase in food price, after falling below 5% in the previous month. Nevertheless, core inflation stood at 4.1% and continues to maintain downward momentum. As widely expected, the Reserve Bank of India (RBI) to maintained a pause in its December monetary policy meeting. Crude oil prices inched to $73 levels but ended down 7% at $77. Crude rose from its December low as Houthi attacks on vessels in the Red Sea forced tankers and other ships to divert on longer voyages, boosting costs. Nonetheless, in 2023, crude declined 10% due to geopolitical conflict in the Middle East and concerns about the oil output levels of major producers around the world.

► Macro indicators remain favourable: Domestic demand remained robust even as there were signs of moderation in November driven by the festival-related holiday impact. Industrial production in October registered a robust growth at 11.7% compared with an upwardly revised 6.2% reading in September, aided by a favorable base effect and pre-festive sequential pick-up. Manufacturing sector grew 10.4% while consumer durables and consumer non-durables grew 15.9% and 8.6% respectively. PMI manufacturing rose to 56 in November from 55.5 in October, remaining in expansionary zone since July 2021. Meanwhile, credit growth rose to 16.3% in November from 15.3% in October.

Market View

Equity MarketsIndian markets trade at premium valuations in context of long-term averages - both in absolute/relative terms. NIFTY EPS growth expectations for FY24E are 17%/20% and FY25E are 14%/15%. Recent earnings revisions have been resilient and better than long term trends. Despite India's persistent outperformance, PE valuations of large-cap indices, e.g. the Nifty50, are close to their five-year means. This suggests that a rotation to large-caps is imminent and some caution in mid-caps is warranted bringing us to the important aspect that's valuations. Currently, valuations in India are expensive relative to the Asian peers and India remains the most expensive market (on both forward P/E and trailing P/B basis).

The earnings outlook for India remains strong relative to the emerging markets. In terms of earnings growth drivers, healthy credit demand and bottoming margins in case of banks should lead to high earnings visibility and strong profitability over the next few years. Within non financials, robust high end consumption demand and recovery of private capex cycle recovery in the second half should drive earnings growth.

Growth in the next few months is likely to be driven by election related spending which should boost consumption demand. Post elections, we expect investment growth to take centrestage particularly from the private sector. If the state elections are any indication, the risks from general elections are quite low and in our view policy continuity would set the stage for a further rally in equities. In the near term, slowing growth in the developed economies could exert pressure on external demand thereby acting as a drag on exports.

Debt Markets

Finally, a pause in the developed economies and policy speak by the central banks suggests that interest rates have peaked globally. In the US, the economy is beginning to show signs of moderation despite a stronger than expected economic growth. Given the Fed's projections, markets are already anticipating the rate cuts and yields have come off more than 120 bps from the highs of 5%.

On the domestic front, as we had expected, the RBI remained on hold and is expected to be on hold at least till June 2024. With fiscal consolidation on course, external balance remaining eminently manageable and forex reserves providing cushion against external shocks - Indian economy does remain strong. Consequently, the central bank further raised the growth forecast for the year from 6.5% to 7% and remained confident of robust growth. Even though the RBI expects slightly higher numbers in November and December, it is not meaningfully worried and expects inflation to head lower over the next one year. The RBI believes that the transmission of the previous rate hikes is still an ongoing process. If inflation is 4% by Sep 2024 as is the forecast, we could see market expectations around future policy build up in that time frame.

We believe, the RBI has already engineered a rate hike in last 3 months by moving the operative rate from 6.5-6.75% by keeping banking liquidity extremely tight. We believe as financial conditions globally and pressures on the rupee have significantly eased, RBI will ease its liquidity stance to Neutral from tight in February or April monetary policy which would lead to 15-20 bps of rally in our markets. We believe that RBI will cut rates only after Real rate goes above 2%. Our belief is that the central banks of developed markets would be more aggressive in cutting rates as compared to those in emerging markets.

Most part of the fixed income curve is pricing in cuts only after June 2024. With policy rates remaining incrementally stable, we have retained our long duration stance across our portfolios within the respective scheme mandates. We do expect the 10-year bond yields to touch 6.75% by April - June 2024.

Source: Bloomberg, Axis MF Research.